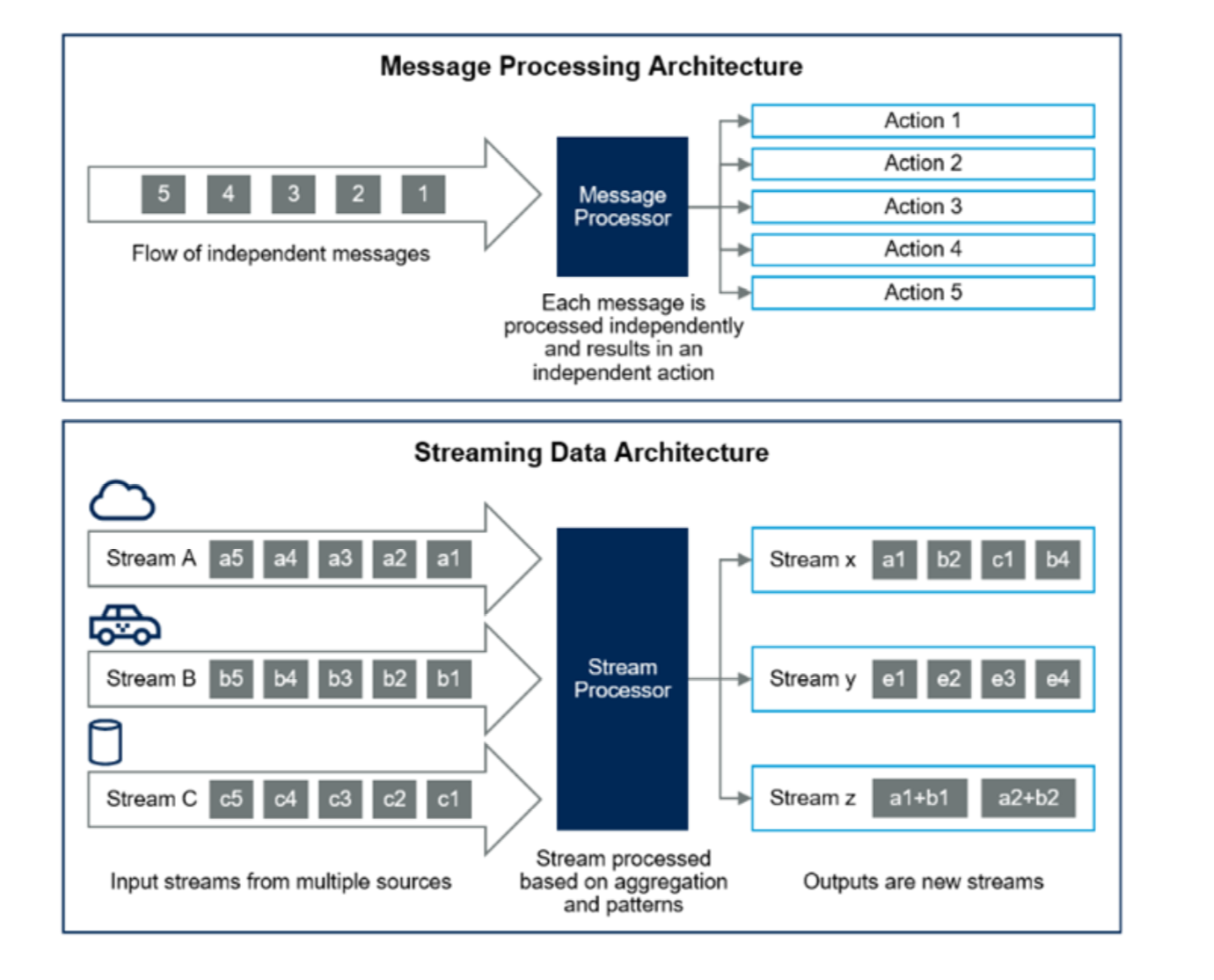

Message processing vs stream processing architecture

- by Alex Antonatos

-

A quick simple diagram differentiation between message processing and stream processing architecture.

-

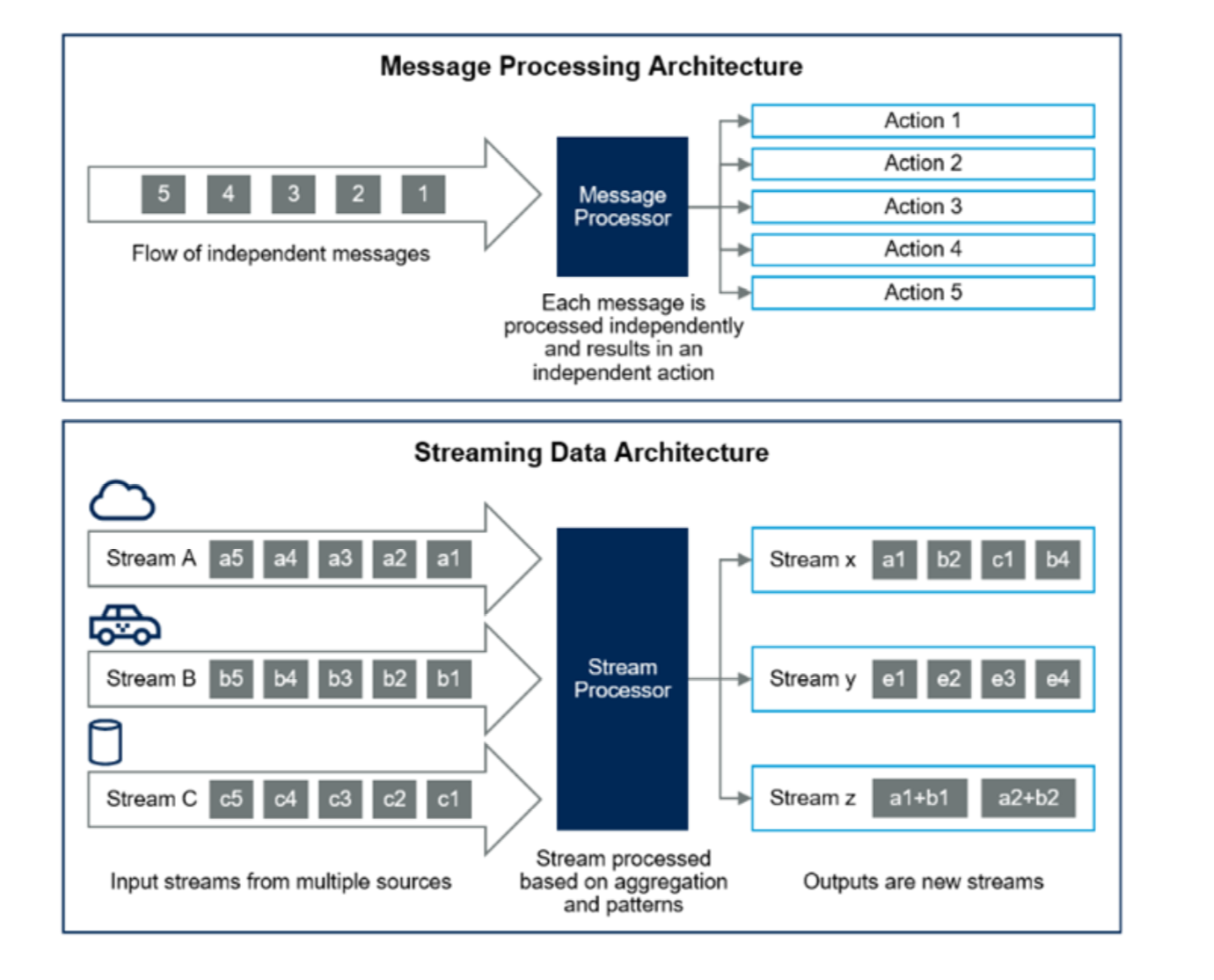

The stream processing pattern bears many similarities to the message processing pattern that you are familiar with, but in stream processing, the processor looks at one or more streams as a whole, rather than at discrete messages

-

Streams are aggregated, combined and filtered to observe patterns and enrich data. The output of a stream processor is itself a stream, which may consist of filtered or mapped data or events.