Adapt your sprint delivery, don't follow textbooks or best practices

- by Alex Antonatos

The question that is asked often by clients: How often do you release your product to your end users? How often do your end users see and use your product? Do you release in sync with your Sprint length, is it after the Sprint Review? Is the Sprint Review meeting the only valid release point? When do you plan your releases? Always adapt your Scrum and Continuous Delivery to build the right thing, - EVERY COMPANY IS DIFFERENT this takes time at the start to get used to working in this type of environment when implemented properly, release it as planned to ultimately deliver superior value to your customers. Its exactly the same as you ever wondered why your fingers are different sizes?

In short, our fingers are uneven for various reasons, and all theories suggest the evolution of the hand is tightly related to its functionality , same as sprint delivery every company functions differently.

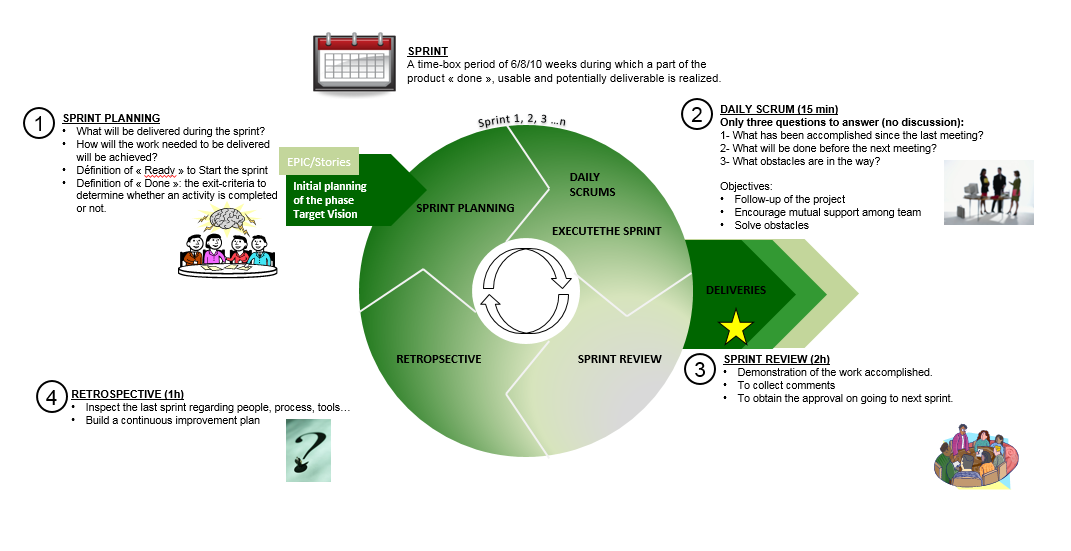

Below a step by step approach that you should adapt to your company needs: