Why implement a centralized CRM package - Main Pitfall & 5 tips

- by Alex Antonatos

In my view, the top 10 reasons most companies move towards a centralized CRM (customer relationship management) system

- Move to get a more complete view of customers

- Automate previously manual and repetitive processes

- Make business processes consistent across the company

- Improve the quality and velocity of data. Enter once. Use many times.

- Replace of various systems/databases by one system

- Improve sales force efficiency, forecasting

- Deploying CRM enables corporations to become more customer-centric with their business processes

- Better user access to data and instant mobile analytical tools

- Improve communication among groups within sales and marketing organizations

- Leverages best practices throughout the organization

A CRM system provides a one face to the customer and a 360 degree view of sales and opportunities, by establishing the reflex of having a common customer ID across data dimensions, you can provide visibility to all of the customer-related activity across the enterprise.

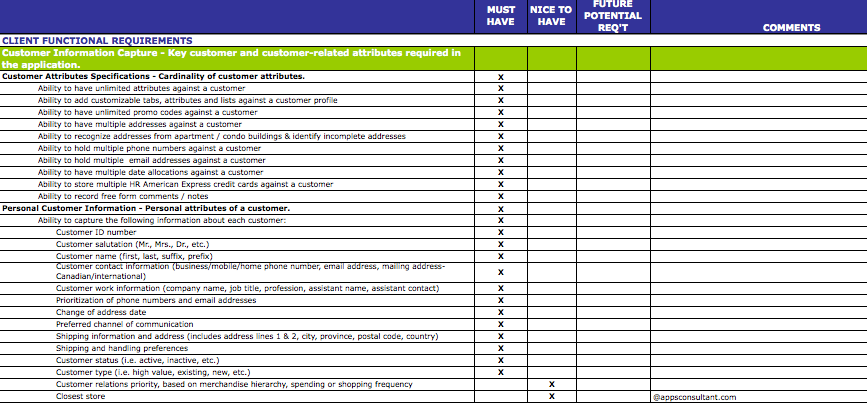

Tip #1 Dont focus on functional requirements

When focusing on functional requirements take into account all Tier 1 CRM, share the same functionalities, provide a better scoring to the vendor that is already deployed internally, for example if your company is more Oracle centric select Oracle if its SAP centric select SAP, this will help reduce the risks related to integration.

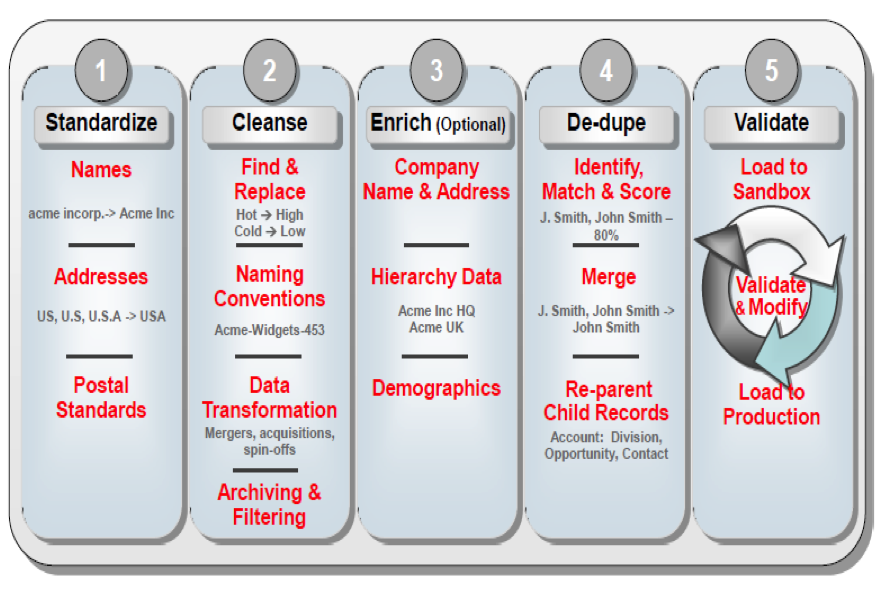

Tip #2 Biggest risk will always be the data migration

In a CRM project, put a focus on the data migration, bad data is the number 1 reason for project failures and overruns:

Main Pitfalls of Converting Bad Data

• Inaccurate report metrics

• Bad information wastes users time and effort

• Marketing wastes money and effort pursuing bad prospects

• Understanding your “customer” is impossible

• IT wastes time sifting through information and trying to make sense of it

• Operations has difficulty reconciling data against financial and other backend information

• User get frustrated, you lose valuable buy-in and adoption

Follow a structured approach and limit your initial scope of your data migration to converting:

Accounts, Contacts, Addresses, Opportunity, Products, Notes, Attachments and Territories.

Tip # 4 Data Cleansed then Loaded into CRM

Define key systems where data will be cleansed and then convert to CRM

Do the same with the transactional data, that will be loaded into CRM and which loaded into the BI for analytics

Tip#5 Setup CRM Center of Excellence

I would say that the Achilles heel to all IT systems especially in CRM systems is user-friendliness. If in doubt, use the KISS method'Keep It Simple Stupid'. Do you have 2 ways you could do something? Always work with the simpler of the two. It's much easier to add a bit of detail rather than trying to take away from an overly complicated process.